Join UAPCS Executive Director Royce Van Tassell and Communications Director Tamra Watson for updates on the 2026 Legislative Session. These online briefings provide:

- Timely updates on bills impacting education & charter schools

- Insights into legislative activity and anticipated movement

- Space for questions and real-time clarification

Week One: UAPCS Legislative Watchlist

Print Version: HOUSE and SENATE

HB 241 S1 - Email House Education Committee

Meeting Summary:

The meeting focused on providing a legislative update for the 2026 session, with Executive Director Royce Van Tassell and Communications Director Tamra Watson discussing budgetary concerns, ongoing funding priorities, and several proposed bills.

Education Funding: Royce provided an update on the 2026 legislative session funding priorities. He explained that while there are proposed budget cuts due to lower than projected income tax revenues, public education funding for FY27 is expected to increase. He emphasized that these are recommendations and the legislature prioritizes public education spending. He also mentioned that the legislature may focus primarily on improving data collection in public education.

House Bills: They reviewed HB 241-S1, which aims to allow charter schools to bid on district facilities, and HB 234, which introduces a pilot program for alternative statewide assessments. HB 142 was also reviewed which addresses fee waivers for student trips, limiting eligible students to two trips per year

Senate Bills: They reviewed SB 186 which seeks to review and potentially increase base funding for charter schools. SB 58, aims to improve attendance data collection. Technology has also been a topic with SB 69, to establish a default no cell phones in school (bell to bell), but permit local LEAs to establish their own policy if desired; and SB 88, which would enable a parent to review/monitor the internet activity and content of their child's school-managed device

Call-to-Action: We request charter schools contact representatives serving on House Education Committee, regarding HB 241-S1, which proposes when a district decides to sell one of these properties, charter schools have the same opportunity to buy as cities do today.

Week Two: UAPCS Legislative Watchlist

Print Version: HOUSE and SENATE

Summary Generated by Zoom AI

Charter Schools Construction Bill Update

Tamra Watson, Director of Communications for the Utah Association of Public Charter Schools, led a legislative update meeting. They discussed Senate Bill 164, which transfers oversight of public construction to the Division of Facility Construction Management, and highlighted concerns about its potential impact on charter schools' construction timelines and budgets. The meeting was cut short due to an upcoming House Education Committee meeting, and the meeting summary would be posted online the following Monday.

SIS Consolidation and Charter School Rights

The group discussed two key pieces of legislation: House Bill 407, which proposes consolidating SIS systems with increasing penalties for non-compliance, and House Bill 241, which grants charter schools equal purchasing rights for underutilized or vacant buildings. Beehive Academy expressed concerns about the complexity and impact of changing SIS systems, noting that such changes can take years to fully implement and affect more than just data reporting. The conversation ended with a brief overview of House Bill 243, which proposes a pilot program for using nationally norm-referenced assessments.

Character Education Bill Discussion

The meeting focused on discussing House Bill 399, which aims to amend primary and secondary education with a focus on character education. Tamra and Royce are opposed to the bill, believing it will likely die in committee, and Royce has shared concerns about certain terms used to define character education. Tamra assured attendees that their feedback is valuable and encouraged them to continue providing input as the legislative process unfolds. Additionally, Tamra expressed gratitude to LEA leaders for their support during Charter Day on the Hill, which was a successful event attended by nearly a thousand people.

Week Three: UAPCS Legislative Watchlist

Print Version: HOUSE and SENATE

Summary Generated by Zoom AI

Legislative Feedback and Bill Review

The meeting focused on legislative updates and feedback collection. Tamra emphasized the importance of using the feedback form to provide input on legislative updates, as it helps streamline the review process. Royce invited participants to share specific bills they wanted addressed, and several participants, including Deborah and Nathan, mentioned HB 399, HB 186, SB 88, and HB 273. Royce and Tamra committed to covering these bills in future discussions.

Acadience Reading vs RISE Test (SB241)

The group discussed the differences between the Acadience assessment and the RISE test, with Royce explaining that the Acadience tool provides a more comprehensive view of student progress through multiple assessments (3 times) throughout the year, while the RISE test is a single snapshot. They clarified that Senate Bill 241 does not mandate retention for all students who do not meet benchmarks, but rather requires individualized student evaluations with a focus on providing appropriate support to help students reach proficiency. The discussion also touched on funding increases, with Royce mentioning a 4.2% increase in WPU value and a $165 per student increase in the Local Replacement Fund.

Technology Bills and Funding Predictions

The group discussed several technology bills, with Jason confirming there were two technology bills. Royce expressed confidence that Deborah's HB399 and Karen Kwan's SB106 would not pass, noting that Republicans are committed to Utah Fits All. Regarding SB186, Royce predicted that while the full $30 million increase for charter schools was unlikely, a one-time funding amount would be approved, and a provision directing stakeholders to examine funding gaps between districts and charters would likely succeed. The group agreed to review the Public Appropriations Committee's recommendations on Tuesday.

Legislative Bills and Education Standards

The meeting focused on several legislative bills, including Senate Bill 88, which allows LEAs to provide parents with a whitelist of websites for school-issued devices, and Senate Bill 69, which has encountered minimal resistance. Royce explained that Senate Bill 88 requires filtering software and noted that it has already crossed over from the Senate to the House. The group also discussed Senate Bill 241, which proposes using the Acadience benchmark tests instead of RISE scores to measure third-grade reading levels, with Royce presenting data showing that many schools are already above the proposed 80% standard. Stanger Jason inquired about funding for parent accessible monitoring, to which Royce responded that he would check and follow up.

Legislative Initiatives for Education Security

The meeting focused on several key legislative initiatives. Royce discussed Senate Bill 241, which redirects $9 million for literacy coaches, expressing concerns about the gatekeeper function assigned to RESAs and school districts. He also reviewed House Bill 407, which aims to implement a statewide student information system, predicting it will significantly reduce administrative reporting burden. The group also covered House Bill 234, a pilot project allowing charter schools to opt into alternative testing methods, with associated costs of $13-25 per student. Royce concluded by outlining three school security bills (HB43, HB44, and HB42) and emphasized the importance of implementing cybersecurity measures, including multi-factor authentication and data backup plans.

Week Four: UAPCS Legislative Watchlist

Print Version: HOUSE and SENATE

H.B. 440 -S1, School Lunch Amendments :

(Make sure to look at Amendments)

This bill enacts provisions related to school community councils and meals and recess in public school

Some concepts to consider:

- Provide elementary students with at least 20 minutes of eating time.

- Schedule recess immediately before lunch.

- Ensure each meeting is open to the public, with parents notified in advance.

- Issue a survey to the school community to solicit feedback on the school‑lunch target goal (lines 309–338).

Require the director or principal to submit the approved school‑lunch plan to the State Board of Education.

Require an annual signed report explaining the reasons why the goal was met or was not met.

H.B. 350 - Foods Available in Schools Amendments

This bill strikes charter school exemption (line 57) from being able to sell, donate, offer or serve on school grounds food that contains:

- potassium bromate;

- propylparaben;

- titanium dioxide - used to whiten sauces and dressings, i.e. ranch, blue cheese or Caesar; or brighten dairy products (yogurt, cream) or soup bases.

- FD&C Blue No. 1;

- FD&C Blue No. 2;

- FD&C Green No. 3;(vi)

- FD&C Red No. 3;

- FD&C Red No. 40;

- D&C Yellow No. 5;

- FD&C Yellow No. 6

Some concepts to consider:

- School and/or community pantries are exempt from this provision

- Parents may send student to school with said ingredients

- Does not apply to vending machines or school events

Week Five: UAPCS Legislative Watchlist

Print Version: HOUSE and SENATE

We request charter schools contact Senators serving on the Senate Government Operations & Political Subdivisions Committee BEFORE MONDAY, regarding HB241-S3 (Charter School Amendments).

Why this bill matters to Utah Families:

Parents Want Choices: Charter schools are growing—even in areas where overall enrollment is flat or declining. In 2025, charter enrollment increased by 3.2%, showing strong demand. This bill states clearly, charter schools are part of public education.

HB 241 S3 Levels the Playing Field: Across Utah, many school buildings sit empty or underutilized. HB 241 ensures that when a district decides to sell one of these properties, charter schools have the same opportunity to buy as cities do today.

Access to Buildings is Tough - Opening or expanding a charter school is tough. One of the hardest challenges is finding suitable land and facilities.

A Smart Solution for Empty Schools: When a high-performing charter school attracts students in a district with declining enrollment, it makes sense to let that charter use a building that’s no longer serving students

Visit our easy-to-use contact form to access a preformatted (and editable) email template for sending a message to committee members. You’ll find this tool at the bottom of the page, just below the pictures.Past Session Briefings & Summaries

Legislative Recap and Member Meeting

Cole Kelley, District 12, Utah State Board of Education

- Mr. Kelley teaches at American Fork High School. He is a “kid-centered teacher” and hopes to bring that focus to the board; kids over systems. He seeks to eliminate red tape for teacher licensing. If there are regulations and other things that bog teachers down, he wants to eliminate them. He is not afraid of change and wants to make things easier for teachers and focused on students. If you have any suggestions, please contact him: (801) 830-4191, cole.kelley@schools.utah.gov

Announcements

- UAPCS Charter School Conference, A Legacy of Learning: 25 Years of Charter Schools in Utah

- June 10-11, 2025 @ Davis Conference Center in Layton, UT

- Early Bird Registration Ends March 16th

- Call for Presenters

- Circle of Excellence Awards-We know there are great things happening at your school! Please consider nominating someone today-it’s a quick and easy application!

Links for Zoom meetings on our Event Calendar

Legislative Update-Royce Van Tassell

Discussion

- Potential Supreme Court Case re: Oklahoma Catholic Charter School

The question for this case is if a state has a charter school law, and a religious entity applies to open a charter school, is the state required to accept the application? The court is accepting amicus briefs (statements of support, opposition, or information for the court) until April 7th. Utah is working with the National Alliance for Public Charter Schools to submit an amicus brief in opposition to the court ruling in favor of religious public charter schools.

Why does it matter? In the case of Utah, if the court rules in favor of religious public charter schools, the specific implications are unclear. For many states, if the Supreme Court rules that charter schools are not public schools, then the funding formula is not valid. The per student funding to charter schools wouldn’t apply to charter schools which could mean that charter schools would have to fight year after year over general funds, since they would be excluded from public education funding.

We are skeptical that won’t happen in Utah because our state constitution says that public education is what the legislature states it is. The legislation states that charter schools are part of the public education system in Utah. A court ruling in 2001 said that vouchers can be used to pay for private religious schools because parents, not the state, make that choice. For charter schools, the state is making that decision (to allow the school) and not parents.

What do we forsee as the outcome? It is hard to determine. The ruling would need to be a 4/4 or a 3/5 ruling since Justice Amy Coney Barrett recused herself from accepting the case and so is assumed would recuse herself from hearing the case (see article below for reasoning). Oral arguments would be heard the last 3 days in April with a ruling made the last 2-3 days in June.

You will be hearing a lot more about the case in the general media after April 7th and all the amicus briefs have been received.

Royce referenced a New York Times Article further explaining the legal case:

The Urgent Supreme Court Case That’s Not Getting Enough Attention

Final funding

- The LRF is the local replacement fund. It is roughly a state-wide average of what school districts receive from property tax. There was discussion about the increase in the LRF. The Utah Taxpayers Association publishes a School Budget report that helps explain the tax funding sources of public education. See the 2024 Report HERE.

- The qualifying teachers or “educators” as defined in HB 2 Public Education Budget Amendments include the following:

53F-2-405

Effective 07/01/25. Educator salary adjustments.

(1)As used in this section, "educator" means a person employed by a school district,

charter school, regional education service agency, or the Utah Schools for the Deaf and

the Blind who holds:

(a)(i)a license issued by the state board; and

(ii)a position as a:

(A)classroom teacher;

(B)speech pathologist;

(C)librarian or media specialist;

(D)preschool teacher;

(E)mentor teacher;

(F)teacher specialist or teacher leader;

(G)guidance counselor;

(H)audiologist;

(I)psychologist; or

(J)social worker; or

(b)(i)a license issued by the Division of Professional Licensing; and

(ii)a position as a social worker.

- Educator Support Professionals are defined in the same bill as the following:

(a)(i)"Education support professional" means an individual:

(A)whom an LEA or RESA employs and directly pays; and

(B)who is assigned to work in a school setting.

(ii)"Education support professional" includes the following categories that an LEA

reports to the state board:

(A)instructional paraprofessionals;

(B)library paraprofessionals;

(C)student support; and

(D)school and other support, including employees like janitors, bus drivers, and

food service.

(iii)"Education support professional" also includes an individual in LEA or RESA

administration or administration support if the individual works exclusively in a

school setting supporting students.

(b)(i)"Qualifying employee" means an education support professional who was

employed by an LEA or RESA as of September 1, 2025.

(ii)"Qualifying employee" does not include:

(A)a licensed school-level educator;

(B)school district employees who are assigned to work in the central

administration of the school district, including superintendents, deputy and

assistant superintendents, area and regional directors, curriculum specialists,

and support staff; or

(C)individuals with whom an LEA contracts but does not directly pay the

individual or report the individual to the state board in annual employment

reports.

- For the final legislative BUDGET SUMMARY (Office of the Legislative Fiscal Analyst) : https://le.utah.gov/interim/2025/pdf/00001971.pdf

- Public Education summary is on page 8.

- Career and Technical Education Catalyst grant is designed to help existing schools expand CTE programs, encourage schools without CTE programs to develop one, and make it easier for schools to have a CTE program. The Davis County Catalyst center serves as a model for robust CTE programs.

- This bill changes requirements for window treatments. It also sets dates for compliance with window treatments (see lines 233-242).

- We checked with Shauntelle Cota, USBE Director of School Safety and Student Services. Schools will need to have another school safety assessment by October 15, 2027. (New requirement is once every three years and all schools had an assessment by December 31, 2024.)

- We anticipate USBE will update the school safety book with updated amendments from the bill mid-April.

- We discussed the change in window treatments from film to glazing. HERE is the Wall Street Journal article that speaks to the efficacy of window treatments.

Thank you for joining us. If you would like a recording of the meeting (we did not get to all the bills), please email gina@utahcharters.org.

The Governor’s Education Budget final recommendations were released today. Here are some highlights:

- 4% increase in the WPU

- $50 million – $1,446 salary increase for teachers

- $1,000 direct salary increase, $446 for the educator salary adjustment included in the base budget

- $50 million – $1,000 bonus for educator support staff

- $178 million – 4% funding increase to raise salaries for all school district employees

- $77.7 million – Educator professional time

- $65 million – Career and Technical Education Catalyst grant program

- $14.3 million – Teachers’ supplies and materials

- $12.4 million – Stipends for Future Educators grants for student teachers

- $7.3 million – Grow Your Own Educator Pipeline Grant Program

- $795,700 – Support for professional liability insurance premiums for Utah educators

“Educator support staff” is what has historically been called “classified” staff. Effectively, it’s non-administrative employees which do not require a license.

There is a 9% increase in the LRF that is already appropriate in the budget.

There was a question about adjusting teacher salary schedules to reflect the increases. Royce recommended they be adjusted because the money appropriated for teacher pay increases will just be allocated directly for that.

There was a question about whether this was new because some of these categories weren’t discussed previously. Royce said that yes, they just came up and will most likely be adopted in Executive Appropriations Committee.

HB 219: This was not included in the news release appropriations, but we are certain that the $4M will be funded to allow 20-25 more charter schools to take part in the moral obligation program.

HB 303: This passed the House Floor yesterday. Many thanks to those that reached out to their representative to help. It will be heard in the Senate Education committee Monday afternoon.

HB 40: The funding for school safety is still unknown with recommendations from different organizations ranging from $75M-$130M. One requirement change in this bill will be from using window film to using window glazing to add bullet-proof protection. Window glazing in 2-4 times expensive as window film.

HB 77: This flag display bill will most likely pass but will also likely be challenged soon after in the courts.

SB 102, S7: The sunset reviews for programs are moving forward with little opposition. This does not automatically shut down programs, but sets a date for review.

SB 267: There is sticker shock to charter schools for payment to the authorizers. However, the intent of the bill is to have no fiscal impact to charter schools. Royce is meeting with Sen. Johnson later today to discuss.

HB 100: Food security amendments bill is unsure. The funding for this bill is unsure.

HB 104, S4: The firearm safety bill has reduced the original requirements of the education, one lesson in elementary school, one lesson in junior high, and one lesson in high school. The specific requirements will be fleshed out in board rule.

If you see a bill that is listed in the House Education committee, it most likely is stuck and won’t be passed.

HB 246: This applies if your school wants to be an SOEP provider. The service portal will have a fix in the coming year.

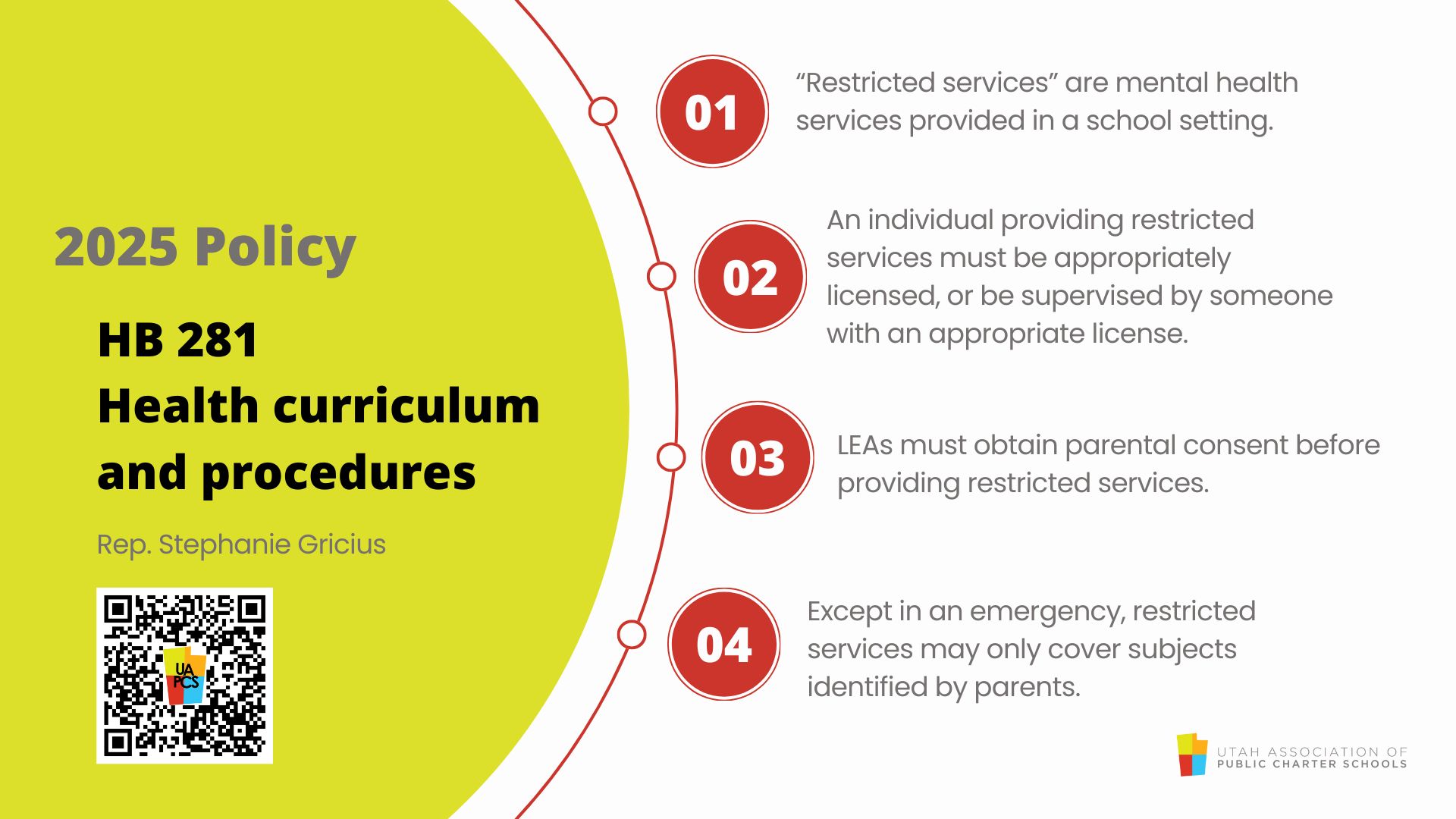

HB 281, S2: Amendments were made after clarifying questions from mental health providers.

HB 344, S1: School fees bill has passed. There will be follow ups on.

HB 381: Civics education looking to increase .5 credits to 1.0 credit of a graduation requirement.

HB 402: School additives and dyes bill; charter schools have been cut out of the requirements.

SB 267: We met with Senator Johnson this week regarding this bill. There was concern about the first iteration of this bill and the costs going to the schools from this bill. Royce is working closely with SCSB and legislators on this.

HB 219: The credit enhancement bill hasn’t received a no vote. Things seem to be going well for its passing. The appropriation of $4M needs to be approved.

HB 303: This bill on public school directory sharing was heard in the House Education committee this morning. There were a couple of amendments to get it out of committee: 1) Information released is narrowed to not include students’ names. The information released will be parent’s name and address and student grade. 2) LEA can request information from an LEA if the requesting LEA has a building within 50 miles of the source LEA. This prevents statewide requests from online schools. The compromises were necessary to get something passed. We anticipate that HB 303 will be on the house floor in the middle of next week.

HB 40, S4: School safety bill amendments include updates regarding window film. As more information on the efficacy of window film has come out, the bill will require safety glazed glass (2-4xs more expensive than window film) as that is more effective than film. We are still unsure about the appropriations going to help pay for this more expensive options. Since revenue projections are down (even from December projections) it is doubtful that there will be money appropriated to fund everything, including ongoing money for the guardian program.

SB 102: The sunset dates in the bill are to set dates for review and not necessarily to cancel the programs. In the 7th substitute they removed professional staff costs, but those costs were recommended by the Ed Appropriations committee. The money for that program, if passed, will be redistributed on a per pupil basis to all LEAs.

HB 402: Foods available at schools in this bill will remove foods with certain additives and dyes. The estimate for this would increase school lunch costs of 10-30%. They are working to stop this bill in committee next Tuesday. We may send out an email on Monday to indicate opposition of this bill.

If you have other bills of concern, please let us know!

PDF of Watchlist

Legislative Updates 2/7/25

During first 2 ½ weeks of the legislative session, appropriations subcommittees go through as much of their relevant budgets as possible. The education appropriations committee look at new funding requests and are paying attention to cash balances of school districts, this conversation will continue over the summer.

By Tuesday, the education subcommittee will submit recommendations to the executive appropriations committee. There will be more requests than money available. Top of the priority list of PEA (public education appropriations) is another 1% increase in WPU (already approved at 4%). We don’t know if will be funded, there is little ongoing money available. The next request is $400M toward ongoing funding requests. Some may get funded. On the one-time side, we are likely to see $380-400M requested for projects to be funded that haven’t already been funded. They are seeking for Paid Professional hours to continue. The State Board of Education asked for a reduced amount of funding for school safety today and lowered the ask to $50M from $100M.

There was a question about available money for school safety grants. School safety grants submitted recently will be paid from money appropriated last year. This request will affect grants for next year, after Oct 15. Why reduced? State board reduced their requests to reflect what they think will be available. Royce thinks school safety will still be closer to $100M. Reduced ask from USBE will most likely not influence the requirements of the bill. We don’t see a path for new money to support armed security guard on going. There is another school safety bill, not as substantive as last year, that changes school safety assessment date to Oct 15 rather than Dec 31.

Overall, the education committees are moving very slowly, including not meeting as frequently. Not many bills are moving out of House Rules.

HB 218/219: By a human error, the text of HB 218 was stuck into HB 219. HB 219 passed (which was essentially HB 218) by the House Education committee. HB 219 will essentially not continue and be considered this year. HB 218 (old bill, now HB 219) was the priority bill, so it will still help more schools receive access to the moral obligation program if fully passed.

HB 303: We expect this bill will move through House Ed committee on Monday, 2/10. We encourage you to visit our webpage: https://www.utahcharters.org/contact-education-committee and send an email to the entire Education Committee stating your support. We will also reach out to have some administrators testify in person.

HB 42: This bill is off to Senate side. It creates a pilot program for ELL students to get extra dollars. We aren’t sure what the funding amounts will be until appropriations are all set.

SB 102: Some misunderstanding of what a sunset review is. A sunset review of the 8 programs in the bill means that there will be an evaluation of the program. This does not mean that the program will be eliminated at the sunset review date, but rather this sets in place a process for the legislature to look at the programs’ benefits and drawbacks. It is good to get feedback about these programs. The digital teaching and learning grant was reviewed and feedback helped it to be easier to apply for. There can be value in having a review.

HB 104, S1: Firearm safety in schools. We don’t know where this is going to land; it may not pass. The bill states there should be time in schools (2-15 minutes) to train a child what to do if they come upon a gun. As administrators, it is worth taking a look at, some pieces challenging to work through.

HB 246: SOEP. This bill is still in house rules, looking to keep it there.

HB 260, S1: Legislature would like to see schools help graduates get college prep similar to our early college high schools do. Also, recognizing some kids don’t plan to attend college, this bill puts money toward alternative career prep pathways and credentials (ie CNA, electrician, welding, etc.)

HB 344 Fees bill. Bill states each school has to have a pathway for a student to graduate without having to pay any fees, or obtain a fee waiver. Co-curricular fees may not apply.

HB 397: Requires the LEA to pay for student trip fee for students with waivers.

HB 191: Definition of packet hasn’t changed. USBE can’t go through all the packets that they must use. We understand the concern and don’t anticipate the bill passing in the form it is in now because there are so many forms of packets and state board doesn’t have staff to evaluate all packets. There hasn’t been much movement on this. Royce will check and report on next week.

SB 223: Please review this bullying bill and see how this affects schools operationally. Send Royce email with concerns or kudos.

FYI: Charter schools nationally may be in the news in April and June. Oklahoma Catholic diocese was granted authority to open and run a charter school. Oklahoma Supreme Court ruled it unconstitutional. The US Supreme Court will hear the case April 26-28. They will release their decision the last week of June. Amy Coney Barrett recused herself from case, so only 8 justices will rule. You will see news stories around it. All of charter community outside of Oklahoma sees this as a troubling possibility. We are not hearing interest of opening a religious charter school in Utah. Our state constitution and state code prohibit it. Those sections of our code will have to change if overruled by Supreme Court.

Discussion of Executive Orders. Presidential Executive Orders are given to agencies and not schools. Schools should continue their work as usual until directed by their governing agency to change. For schools that agency is the State Board of Education. For UAPCS and our federal grant, it is our Program Officer.

We will continue to monitor Executive Orders and respond as necessary. We do anticipate a EO to federal agencies (Department of Education, Department of Defense, Department of the Interior, and Department of Labor) to help expand charter schools. The National Alliance for Public Charter Schools is putting together three working groups to help determine how to make that happen.

We are watching to see how the Supreme Court rules on the case of a religious (Catholic) public charter school being authorized in Oklahoma.

Utah Bills:

If you have an opinion or suggestion for any of these bills, please email or call/text Royce. We value your insights! royce@utahcharters.org (801) 836-7028.

HB 260, S1 First credential program: Expands program to provide industry credentials to high school students. There is concern that the complexity of the bill won’t accomplish the intended purposes. If you have suggestions on CTE education and helping this bill be successful, please reach out to Royce. We are working with educators to make it easier to accomplish the goal of the bill.

HB 303 Public school directory sharing amendments: We anticipate this will be heard in the House Education Committee next week. We would love support to get this passed so all students know their school options.

HB 218 Charter school funding amendments: Schools need an investment grade rating to participate in the moral obligation program. This bill will expand the evaluation standards to allow 15-20 more schools the ability to participate.

SB 102, S2 Public education funding modifications: The bill sets sunset reviews of several programs. It also directs the legislature to put the funding into flexible allocations if the program is discontinued. The programs in the bill include the following: Enhancement for Accelerated Students Program; concurrent enrollment funding; student health and counseling support; Teacher Student and Success Program; dual language immersion; Digital Teaching and Learning Grant Program; grant for professional learning; and professional staff weighted pupil unit.

SB 111 Public education governance amendments: There are several bills that deal with how the legislature and USBE interact resulting in issues with previous USBE members. We are watching the bills, but they do not directly impact schools so may not be included in our watchlist.

HB 281 Health curriculum and procedures amendments: We would love input regarding the sexual education curriculum changes made in this bill. The recommendations for the changes have come through the state board. This bill focuses around in-school mental health counseling and sets parent-driven parameters to counseling.

Transportation: Royce is visiting with the Appropriations Committee on Monday, February 3rd to talk about charter school transportation funding. This will be an on-going discussion. We would love input from you on why transportation funding is needed. Here is a link to our Transportation Survey: https://docs.google.com/forms/d/e/1FAIpQLSdw-e0AqyLuaEVXj7-ZlwZAVffKQuXxozH6NF9wdwsM0ljbSA/viewform?usp=dialog.

Questions:

There was a question about HB 100 Food security amendments by Rep. Clancy. This bill is unlikely to pass due to its fiscal note (too expensive). This also applies to SB 173 by Sen. Escamilla.

Legislative Watchlist (Click here for PDF)

Discussion about Trump Executive Orders and affects on schools:

- Have policies regarding student pick-up/drop-off in case parents are unavailable.

- UAPCS can share suggested policies as requested: email gina@utahcharters.org

We are opening discussion on charter school transportation funding. Funding most likely not available this year. Questionnaire about transportation needs will be sent out (Who has a bus? Who uses public transit? Etc.)

HB 40 School Safety-Not a lot of new things added this year. Changes school safety assessment deadline to October 15. One-time money suggested allocation of $130 from governor's budget. On-going money probably doesn't exist.

HB 77 Flag Display Amendments-If a flag is displayed, it has to be on approved list. Does not define what a flag is.

HB 218/219 Charter School Funding Amendments-Continued from last year. Would double school that qualify to use the moral obligation program. Opens more funding in the revolving loan so more capital projects can be taken on.

HB 303 Public School Directory Sharing Amendments-LEAs need to share directory information.

SB 102 Public Education Funding Modifications-multiple programs under review. Bill establishes sunset dates and allocates that funding will go to flexible allocation if the program is repealed.

Programs include:

- Enhancement for Accelerated Students Program

- Concurrent enrollment funding

- Student health and counseling support

- Teacher Student and Success program

- dual language immersion

- Digital Teaching and Learning Grant Program

- Grant for professional learning

*Beverly Taylor Sorenson Arts program pulled off bill since discussed on Friday, January 24, 2025 in Second substitute bill.

There was discussion around how the changes in funding stream could negatively impact some smaller schools who rely on specific funding tied to programs to be able to offer the program than a potentially lesser amount if the funding is rolled into flexible allocation.

HB 104 Firearm Safety Bill-This curriculum already exists. Held in committee.

HB 121 Health Education Amendments-Deals with mental health counseling at school

SB 111 Public Education Governance Amendments-Requires that a corrective action plan administered by the USBE has to be voted on by the USBE (not just administratively).

SB 105 Student Privacy and Modesty in Public Education-Enacts provisions regarding a student's reasonable expectation of individual privacy and personal modesty in the public education system.

There was discussion about the PTIF (Public Treasurer's Investment Fund) and the amount that some district schools carry while asking for more funding from the legislature.

Question about School Safety Grant:

- LEAs must submit only two items for a complete application:

- The FY25 School Safety and Support Grant Qualtrics Form (found in the Attachments section in the UtahGrants application)

- The 25POH School Safety and Support Grant application in UtahGrants

Watchlist  (click on image for pdf)

(click on image for pdf)

Thanks to those who were able to join us. The 2024 Legislative Session wraps up this Friday at midnight....so should be an exciting week ahead!

Here's what we discussed:

Last Friday, Executive Appropriations Committee announced the budget, and we have good news.

- 5% increase in the WPU was in budget.

- Over the last couple of years, there have been add-ons for at-risk students (gang prevention/difficult to educate) which will account for about another 1% ($27.9M), which is an increase from previous years.

- Paid professional hours increased from $64M to $74M. This functionally means you can still provide same amount of time for teacher training/PD but at higher hourly rate due to inflation.

- There will be one-time money $8.4M school supplies and materials.

- For a full list of items prioritized (pages 6-7 public ed) see https://le.utah.gov/interim/

2024/pdf/00001849.pdf - Notice on the priority list there is a one time cut of charter school local replacement-this doesn’t represent an actual cut in budgets, but a balancing of the budget.

- Ask Royce if you have any other questions.

Bills to watch:

- SB 173: Market informed pay increases (Fillmore): He asked for $200M one-time funding, got $150M in budget. Rubric and structure will be developed by USU Center for Schools of the Future. We will see how details of technical implementation will work out-still a lot to be determined.

- HB 415: School fees (Strong): This is particularly applicable to secondary schools. In 4 years, fees associated w/curricular and co-curricular will go away. One-time money will ease the stepdown. There is no impact for this coming school year, but then steps down funding over next 3 years ($35.5M) to zero that you can charge for those fees. Don’t know distribution method to ease funding challenges-will be worked out with USBE.

- HB 221: Stipends for future educators (Peterson): Received funding for this bill. $4.8M one-time funds for next year. $6K/semester for student teachers.

- HB 84 : School safety bill (Wilcox): One-time money to help with infrastructure $100M one-time and $2M on-going. Most likely will pass. Another substitution coming. There is momentum for this, leadership wants to see pass. In our discussion: question about ramifications for non-compliance. State Security chief can revoke building permit, believes tied to building meeting requirements for safety. Time frame for building renovation compliance? The bill says "reasonable time" and schools can seek waivers as long as in a “reasonable” amount of time. Royce has spoken with Rep. Wilcox and Security Chief about timeframe, could be 3-5 years if bond is required to get and build. They didn’t blanch at time frame. Still don’t know about guardian piece or how schools will pay for the cost of hiring the guardian. Rep. Wilcox thinks Royce takes too pessimistic view of finding guardians within the school, but those challenges still exist. The bill will be on Senate floor w/5th Substitution amendments on Thursday or Friday.

- HB 303 School Neutrality bill (Stenquist): The substitute Monday morning adopted doesn’t apply to social beliefs as opposed to political beliefs (Neil Walter proposed). It is unclear where the bill will go, Royce would be surprised if it got through both bodies in the last week of the session.

- HB 208 Teacher license (Thurston): This is very likely to pass and removes the PPAT as a requirement for teacher licensure.

February 21, 2024

The budget will be released on Friday, 2/23. We will see what educational priorities are funded. Revenue projections from 2/16 were up, so it appears that the additional 1.2% increase in the WPU should hold. The base budget did include a 3.2% increase in the WPU, so if the remaining WPU increase proposed passes, it will be a 5% increase for next year.

Here are the priority bills:

- HB 29, 1st Sub., Sensitive Materials. The Senate modified in committee, but the House did not agree with the changes. A conference committee (both House and Senate members) decided that if a material is removed (3 school districts or 2 districts and 5 charters), the USBE can consider to override the removal within 60 days. If they override the removal, then LEAs don't have to remove the material. Most likely will pass with this change.

- HB 84, 1st Sub., School Safety. The question is in the cost of implementing the armed guard for each school or finding a volunteer guardian. Bill may be amended to make lesser provisions such as bullet proof glass, cameras with law enforcement access, and panic buttons in each classroom. They are looking at one-time funding to help schools be able to afford these recommendations. Estimate for Canyons School District alone is $5M. Implementation could take 1-3 years. State may seek contracts LEAs can participate in for economies of scale on some items. Legislators are still working out baseline safety requirement details.

- HB 182, 4th Sub., Student Survey. Looks like the requirement will be an annual opt in from parents. SHARP survey likely to continue to be administered. Effective date would be July 1, 2024 if passed.

- HB 192 & HB 431, Leave Bills. Both Rep. Pierucci and Rep. Ballard bills likely to pass. The biggest difference is the establishment of a leave “bank” (HB 192), which will be optional. The leave policy will have to be minimally what the State of Utah offers, three weeks paid maternity leave.

- HB 301, 2nd Sub. Charter School accountability amendments. This should pass. The improvements in the bill don't require building contracts to be sent to the State Charter School Board. The changes are designed to have the USBE provide oversight and the SCSB to be in a more friendly, supportive role.

- HB 303 School curriculum neutrality. This is unlikely to pass. There is an understanding that people don't want teachers to be preachers, but the classroom should not be sterilized to the point teachers feel afraid to speak up on anything. Also, the center line of neutrality is different in different areas of the state.

- HB 413, Mental Health Requirements. A substitution is coming due to the resistance to have an automatic opt in. Instead the bill will likely have the schools who don’t report participation either way will be put on a list given to the education appropriations committee. There were 5 charter schools that did not respond last year and so we aim to make that zero schools in the future

- HB 415, School Fees Amendments. The House would like to have all curricular fees covered by 2029. The expense of doing this could wipe out all WPU value increases and change what schools offer. The Senate has never passed a version of this.

- HB 419, Charter School Funding Amendments. The proposed funding of $54M will most likely be reduced to only $4M to bolster the moral obligation program and provide for more schools to qualify. This has passed out of committee and will likely pass. Most likely to be funded just for the $4M and not the entire $54M, but that doesn't change the bill.

- SB 173, Market Informed Teacher Compensation. Fillmore’s bill would provide bonuses of $2-$20K for high-performing teachers as set by USU’s School of the Future rubric and LEA nominations. The bill would also use school administrator and parent input and cover a variety of grades. Depends on the $200M one-time funding it requires.

Here are the non-priority bills:

- HB 105, Teacher Tax Credit, Unlikely to be funded, so most likely won't pass.

- HB 119, Firearm stipend, Stuck in rules and won’t pass.

- HB 269, Ten Commandments Bill adjusted to include that students should be familiar with the Ten Commandments and the Magna Carta.

- HB 208, Teacher Licensing Amendments, Will eliminate the PPAT. This bill should pass. If you have teachers in the UAPCS APPEL program, please wait for announcement from Joylin/April regarding this requirement for your teachers.

- HB 112, Sex Ed Amendments, The term "human sexuality" is not defined in code, so it removes the term from code. Will not affect how sex ed is taught in schools.

- HB 331, School and Classroom Amendments, Requires an incoming kindergartener to be toilet trained. Requires USBE to come up with a rule about this including a process where the LEA can get parent assurances that the parent's student is toilet trained.

- HB 287, Advanced Degree Scholarship, This bill will not pass.

Click HERE for Downloadable PDF

February 13, 2025

The legislature is not adding too many new bills this late in the session.

Here are the bills we covered in the discussion today:

- HB 29, 1st Sub., Sensitive Materials. The Senate modified in committee, but there are not a lot of changes possible. The Senate added the ability of an LEA to override the state-wide ban with a vote in their local board within 60 days of ban notification from the USBE. Discussion in our group offered a 90 day override because some local school boards meet quarterly, or if notification comes in the summer.

- HB 84, 1st Sub., School Safety. This bill is moving to the Senate. The challenge is that nearly every elementary or junior high will have to hire someone as the guard. Most high schools already have a resource officer in place. This potentially would cost $100M state-wide to implement, $150K/school. The Senate recognizes that they can’t use ½ or all the increase in WPU to pay for this. If anyone is interested in meeting with senators and/or Rep. Wilcox about the bill, please contact Royce.

- HB 182, 4th Sub., Student Survey. Looks like the requirement will be an opt in from parents. SHARP survey likely to continue to be administered.

- HB 192 & HB 431, Maternity Leave. Both Rep. Pierucci and Rep. Ballard have maternity leave bills. The biggest difference is the establishment of a leave “bank” (HB 192).

- HB 301, 2nd Sub. Charter School accountability amendments. This just cleans up code.

- HB 303 School curriculum neutrality. This barely made it out of House committee. Please reach out to House members and tell them to vote no on this. The House will most likely be voting on this on Friday or Monday. UAPCS will prepare an email for you to be able to send to your representative.

- HB 413, Mental Health Requirements. A substitution is coming due to the resistance to have an automatic opt in. Instead the bill will likely have the schools who don’t report participation either way will be put on a list given to the education appropriations committee. There were 5 charter schools that did not respond last year and so we aim to make that zero schools in the future

- HB 415, School Fees Amendments. The House would like to have all curricular fees covered by 2029. The expense of doing this could wipe out all WPU value increases and change what schools offer. The Senate has never passed a version of this.

- HB 419, Charter School Funding Amendments. The proposed funding of $54M will most likely be reduced to only $4M to bolster the moral obligation program and provide for more schools to qualify.

- SB 173, Market Informed Teacher Compensation. Fillmore’s bill would provide bonuses of $2-$20K for high-performing teachers as set by USU’s School of the Future rubric and LEA nominations. The bill would also use school administrator and parent input and cover a variety of grades. This is out of committee and coming out of the same funding that has a lot of competition.

- HB 221, Compensation for Student Teachers. They are making the case for funding. Likely to be funded.

- HB 119, Firearm stipend, Stuck in rules and won’t pass.

- HB 269, Ten Commandments Bill most likely won’t pass.

- SB 105, Student Privacy in Bathrooms, don’t believe will pass.

Teacher pay increase of $6K from last year has been put into on-going money but there will not be another bonus/pay increase beyond that.

February 7, 2025

Thank you for joining us! The legislative session is half over! There are 731 bills drafted and 59 passed both bodies with the governor signing 11 of them (Utah Policy email 2/6/2024). The Legislature passed 565 bills at its highest point, but we don't anticipate that many passing this year.

Budget highlights:

- WPU increase of 5% (3.8% allocated in approved base budget + 1.2% recommended by ed appropriations)

- LRF adopted in base budget, $170/student

Education Appropriations Priorities:

Note: Highlighted items of particular application for charter schools

| Rank | On-going Fund Item | Cost |

|---|---|---|

| 1 | WPU Value Increase -Discretionary Adjustment (1.2% for total of 5%) | $50,500,000 |

| 2 | Equity Pupil Funding | $21,080,000 |

| 3 | Rural Student WPU Add-on | $25,900,000 |

| 4 | BTS Arts Learning Program | $3,000,000 |

| 5 | PRIME Expansions | $3,500,000 |

| 6 | Statewide Online Education Program | $3,165,200 |

| 7 | Utah Fits All Scholarship | $50,500,000 |

| 8 | Student Credential Account Statewide Usage | $3,500,000 |

| Rank | One-time Fund Item | Cost |

|---|---|---|

| 1 | K-12 Property Insurance Pool | $96,360,600 |

| 2 | Paid Professional Hours for Educators | $64,000,000 |

| 3 | Long-term Educational Achievement Program | $30,000,000 |

| 4 | Stipends for Future Educators | $8,400,000 |

| 5 | Excellence in Education and Leadership | $200,000,000 |

| 6 | Hope for Utah | $240,000 |

| 7 | Prior Year Plus Growth Contingency | $23,707,300 |

| 8 | Charter School Funding Amendments | $4,000,000 |

| 9 | Small/Rural District Critical Capital Loans | $50,000,000 |

| 10 | Teacher Development, Recruitment, and Retention Through Leadership | $3,800,000 |

| 11 | Teacher Supplies and Materials Increase | $1,000,000 |

Other priorities of particular interest include the following:

Reallocations: SEE FULL REALLOCATION LIST HERE

| 62 | Charter School Funding Base Program | $3,600,000 |

Here are the highlights of education bills:

- HB 419 (Walter) Charter School Funding

This bill adds $50M to the revolving loan and $4M to the moral obligation fund. Looks as if only $4M will go through to help about 25 more LEAs to qualify for the savings on interest rates for buildings. This would save about $5M/year in interest payments. - HB 29 (Ivory) Sensitive Materials

The threshold to remove materials statewide of 3 districts or 2 districts and 5 charters is problematic to many. Senate most likely amend threshold. - HB 84, 1st Sub. (Wilcox) School Safety Amendments

This bill is still under consideration. Please look at lines 1306-1351 School Safety and Security Specialist, and provide feedback on what share of an FTE would be required to fulfill all the stated responsibilities. Please respond to this email or email royce@utahcharters.org. - HB 182, 3rd Sub. (Lisonbee) Student Survey

This bill most likely to move forward (another bill proposed by Sen. Fillmore). This requires a parent opt-in for non-academic surveys. - HB 257 & HB 261 Passed bills

Summaries sent out and available at https://www.utahcharters.org/legislative-updates - HB 182, 3rd Sub. (Lisonbee) Student Survey

This bill most likely to move forward (another bill proposed by Sen. Fillmore). This requires a parent opt-in for non-academic surveys. - HB 301, 2nd Sub. (Lisonbee), Charter School Accountability Amendments

Moving forward, not worried about content. - HB 303 (Stenquist) School Curriculum Requirements

This bill may struggle to get through the House Education Committee. May be hard to pass without being open to changes. We appreciate all the feedback you have given regarding this. - HB 413 (Elison) Mental Health Screener

If an LEA fails to notify the state on using or not using the mental health screener, the LEA will be opted into using the screener and given financial support to do so. - HB 221, 1st Sub. (Peterson) Student Teacher Stipends

On list of Education Appropriations priorities. Will pay student teachers a stipend for their time teaching. $8.4M cost. - SB 173 (Fillmore) Market Compensation for Teachers

Designed to identify the top 25% of educators statewide by a rubric determined by USU Center for Schools of the Future. The top 5% would get a $10K bonus, and more bonuses trickle down to cover top 25% of educators. LEAs would identify top performers and submit to state for bonus money. LEAs would also be able to identify 2-5 categories of high needs teachers and use the money to supplement filling those positions. Allocations would be about $200M over 3 years. Bill would not go into effect until 2027. - SB 137 (Fillmore) Teacher Empowerment

Would give teachers the same authority to remove a student from the classroom as an administrator.

Our discussion included the pros and cons of teachers exercising this authority. Thank you for your comments-Royce will share them with legislators. If you have additional thoughts to share, please do so!

DOWNLOAD WATCHLIST AS PDF WITH ACTIVE LINKS

January 30, 2024

Summary of Passed legislation:

CLICK HERE TO DOWNLOAD TABLE PDF

| Bill # | Title | Sponsor | Summary | Fiscal Note | Position | Comments | Location | Priority |

| HB 29 | Sensitive material review amendments | Ivory | Removes an instructional material statewide if 3 school districts or 2 school districts and 5 charter schools find an instructional material constitutes "objective sensitive material" | ($2.2M from the USF*) | Monitor | Hoping the Senate will insist on some measure of local control on this issue | House 3rd | x |

| HB 182, 2S | Student survey amendments | Lisonbee | Requires LEAs to obtain annual parental consent to administer each non-academic survey administered to students; prohibits an LEA from offering a reward or consequence re: student participation in a survey | Support | House 3rd | x | ||

| HB 221 | Stipends for future educators | K. Peterson | Subject to legislative appropriations, creates a grant for educators in a preparation program who are working at an LEA, but may only be paid for their substitute work | ($8.8M from the USF) | Monitor | House Ed | x | |

| HB 257, S2 | Sex-based designations for privacy, anti-bullying and women's opportunities | Birkeland | No impact | Monitor | This will pass | Senate 3rd | x | |

| HB 261, S4 | Equal opportunity initiatives | Hall | Prohibits an LEA from requiring an applicant to submit a statement regarding racism writ large in order to obtain a position or gain a promotion, and prohibits an LEA from providing a training that ascribes moral judgments to individuals based on personal identity characteristics | ($452K ongoing from GF*/ITF*) | Monitor | Senate 3rd | x | |

| HB 413 | Student mental health requirements | Eliason | If an LEA fails to notify the State Board whether they will be a participating LEA in the student mental health screening program, then the LEA will be presumed to be a participating LEA | Monitor | House Rules | x | ||

| HB 419 | Charter school funding amendments | Walter | Expands the credit enhancement program and the charter school revolving loan account | Support | House Rules | x | ||

| SB 98 S2 | Online data security and privacy amendments | Harper | Nominally requires all public and private schools use a .edu domain name, 18 months after K-12 can use that domain name. | Monitor | Definition of governmental entity doesn't include charter schools, though definition of school probably does | Senate 2nd | x | |

| HB 14 | School threat penalty amendments | Wilcox | Mandates expulsion if a student makes a false threat to a school | ($45,000 from GF) | Support | Don't know that we could change this, but ALL cases seems a touch strong | Senate 2nd | |

| HB 22 | Concurrent enrollment provisions | V. Peterson | Expands eligibility for the PRIME scholarship to include students in a youth apprenticeship | Monitor | Unanimously approved by the Education Interim Committee | Senate 2nd | ||

| HB 82 | Public education program modifications | Pierucci | Clean up bill for a variety of education reports; removes fundraising from the definition of a fee | ($93,700 from GF) | Support | House Ed | ||

| HB 84 | School safety amendments | Wilcox | Requires safety procedures, including armed guards, in all Utah public schools when school is in session (among other things) | ($6M from GF/ITF) | Monitor | House Law Enforcement | ||

| HB 103 | Salary supplement for school speech-language pathlogoists and audiologists | D. Johnson | Adds to the list of eligible recipients of the TSSP speech-language pathologists of audiologists with a master's or doctoral degree | ($4,739,900) from the USF) | Monitor | Fillmore/Peterson bill is a better way to address this | House Rules | |

| HB 119 | School employee firearm possession amendments | Jimenez | Provides a $500 stipend to LEAs participating in the program to buy a biometric gun safe for teachers participating in the school safety program | Monitor | House Rules | |||

| HB 121 | Educator background check amendments | T. Lee | Prohibits an LEA from charging the fee to conduct a background check | Monitor | House Ed | |||

| HB 105 | Tax credit for educator expenses | Birkeland | Provides for up to a $500 non refundable tax credit for eligible out of pocket expenses from counselors and teachers in schools | ($25.9M from the ITF) | Support | House Rules | ||

| HB 112 | Sex education instruction amendments | Jimenez | Removes the term "human sexuality" from the definition of sex education instruction | No impact | Monitor | Need to talk to Jimenez about why? | House Rules | |

| HB 167, 1S | Education innovation program amendments | Welton | Makes it easier for teachers to take advantage of the education innovation program | No impact | Support | Senate Rules | ||

| HB 192 | LEA employee paid leave | Ballard | Creates a grant program for LEAs who create a qualifying leave program | ($9.2M from ITF) | Monitor | Funding would be a problem; don't like restricted funds | House Rules | |

| HB 208 | Teacher licensure amendments | J. Moss | Emphasizes the importance of competency as a mechanism for obtaining a teaching license | No impact | Support | House Rules | ||

| HB 247 | Statewide online education program amendments | Johnson | House Rules | |||||

| HB 253 | Use of sex-designated facilities in public and higher education | Lyman | Requires public schools to have sex-designated or unisex restrooms and changing facilities, with sex defined as sex at birth | Monitor | House Rules | |||

| HB 264 | Health education amendments | C. Moss | Expands the sex education curriculum to include strategies for preventing sexual assault and the legal implications of electronically sharing sexually explicit images | No impact | Monitor | House Rules | ||

| HB 269 | Ten commandments in public schools | M. Petersen | Requires public schools to display the 10 Commandments prominently in the school | No impact | Monitor | House Rules | ||

| HB 287 | Advanced degree scholarship program | C. Moss | Uses economic stabilization account money to pay for a scholarship for teachers seeking advanced degrees | ($200M from the Stabilization Account) | Monitor | House Ed | ||

| HB296 | Reading disability amendments | Pulsipher | Adds a definition of dyslexia to the code | No impact | Monitor | House Ed | ||

| HB 301 | Charter school accountability amendments | Lisonbee | Clean up bill for charter school section of the code | No impact | Support | House Ed | ||

| HB 303 | School curriculum requirements | Stenquist | Prohibits schools from using their official position to endorse, promote or disparage political or social beliefs, viewpoints regarding sexual orientation or gender identity, or to encourage a student to consider changing any of the above | No impact | Oppose | House Rules | ||

| HB 391 | Home school student transfer to public school amendments | Cutler | Requires LEAs to write a policy for accepting transfers of credit for home school students based on portfolio | Monitor | I don't know what the home school community will say about a portfolio | House Rules | ||

| HB 418 | Student offender reintegration amendments | Matthews | ||||||

| HB 420 | School code of conduct protections | MacPherson | Codifies existing code of conduct requirements between students and staff members; requires staff membrers to be trained on this code of conduct within 10 days of being employed, and annually thereafter | Monitor | House Rules | |||

| HJR 18 | Joint resolution for education that encourages free enterprise and entrepreneurship | Lund | Title says it all | Support | Introduced | |||

| SB 80 | Public education trust fund amendments | Riebe | Creates a trust fund to pay for local school district personnel | Oppose | Senate Ed | |||

| SB 93 | School climate data amendments | Fillmore | Focuses the school climate survey on student achievement, engagement and safety | Monitor | Senate Rules | |||

| SB 105 | Studenty privacy and modesty in public education | Plumb | Prohibits LEAs from requiring, encouraging or inviting students to undress or change clothing unless they can do so in a space where the facility is single-occupant, or has floor-to-ceiling walls and doors, curtains or similar privacy protections | Monitor | Not clear what impact this would have on building modifications, since none of the options are mandated | Senate Ed | ||

| SB 137 | Teacher empowerment | Fillmore | Indemnifies LEAs against suits brought to enforce non-legally binding federal guidance; empowers teachers to exercise the same authority to remove a disruptive student from class as an administrator; expands the allowable uses for paid professional hours; | Support | Waiting for fiscal note | |||

| SB 138 | High need school amendments | Riebe | Grant program to hire additional first year teachers in LEAs/schools that have traditional definitions of high needs | Monitor | Difficult to believe it will be funded | Waiting for fiscal note | ||

| SB 158 | Youth service organizations | Grover | Would require a charter school sports league (among others) to conduct sex offender registry checks on volunteers or individuals caring or supervising for a child, unless the organization has a different legal obligation to conduct a similar background check | Monitor | Senate Rules | |||

| *USF (Uniform School Fund) | *ITF (Income Tax Fund) | *GF (General Fund) | ||||||

Summary of Zoom Legislative Updates

HB 29: This is an attempt to identify how many LEAs have to have an "objective" sensitive materials issue to cause removal across all schools in the state. Currently, there is a requirement for 3 districts or 2 districts and 5 charter schools. House passed bill as is. Senate may have amendments regarding materials used in concurrent enrollment. There was a question about "age appropriate" materials. There is no statement in house-passed bill about "age appropriate" materials. The "bright line" of pornographic material requirement in law would be there be an "objective" rule about what is considered a sensitive material.

HB 182: This bill requires and opt-in from parents, typically done as one of the many beginning of the year permissions. This is considered because many of the non-academic surverys (such as SHARP or school climate surveys) may introduce sensitive topics such as drug use, bullying, etc.

HB 221: This bill carries a $9M fiscal note and so may not likely pass. This would offer $6000 for student teachers.

HB 257, SB 2: Often called the "Bathroom Bill," this states that bathrooms are for boys or girls, and that those identifying as a gender not the same as their birth certificate would use a single-occupancy bathroom, or a staff bathroom in the K-12 space. The 5th substitution passed the House and Senate. This bill has other stipulations, but we discussed the K-12 applications.

HB 261, SB 4: There are 3 parts to this bill: 1)Do not discriminate. 2)An entity cannot require employees to engage in training that asserts a group of people are significantly more important or less important than a legally protected group. A training can take place, but cannot be required. 3)An entity cannot require an employee to share what they think about a DEI requirement. This bill may have roots in a USBE training that was deemed offensive by delivery of DEI topics while also being seen as a valuable training in many aspects.

HB 413: If an LEA doesn't notify the state of their status to use or not use the mental health screener, then it will be assumed that they will use the screener. The governing board of an LEA needs to vote to use or not use and then report that decision to the state. Several charter schools were non-responsive to the state either way and so not all allocated program money was used. This default will hopefully prompt responses either way.

HB 419: There is currently a charter school revolving fund of $3M, typically given in allocations of $300K loans. This bill takes some one-time money to increase the fund to $50M and allows a school to take 25% of a project to lower the debt interest rate. Also, $4M of one-time money will be placed in the charter school reserve fund-the moral obligation program. The costs of the interest rates shouldn't prevent a charter school from growing, either from adding on to the school, building a satellite, or for new schools.

SB 98: This bill requires that schools use, and pay for, the .edu domain. Cost is estimated at about $450/year and may be required, if passed, within 1-4 years.

Discussion about other bills:

HB 303: Stenquist's controversial topics bill may not cross the finish line. Our frank discussions with him-thank you educators!-have helped him to question the requirements of the bill.

HB 84: School safety bill/armed guard in schools bill hasn't moved in the legislature partly because of the cost to implement. As drafted, this law would cost more than anyone can afford. Something may move forward about school safety but it is hard to say what it will look like.

HB 287: Spackman Moss bill about paying for educator's advanced degrees would need to come from the Economic Stabilization Account of ongoing money that is treated as one-time money. There is $481M in this account, which lawmakers have spent 7 ways over, so there may not be room for this bill to be funded-this would be the same pot of money that HB 419 would need to come from. There will be many bills with fiscal notes, possibly including this one, that may not pass.

HB 331: Welton's bill requiring incoming kindergarteners to be toilet-trained will most likely move forward. IEPs usually exempt students from some requirements.

If you have further questions, please contact royce@utahcharters.org or gina@utahcharters.org.

The USBE has approved 4 vendors that are deemed compatible. Schools are not required to use these systems, but these systems have been vetted for compatibility and may have opportunity for cost savings. Please see the following Award Justification Statements for comparisons:

This powerpoint was shared in the April 24th Administrator's Retreat by Royce Van Tassell. This is a summary of the legislation passed and how it affects you at school and what, if any, policies you will need to create/implement.

Download the POWERPOINT.

The required policy samples from the USBE will be updated as they are prepared.